Betsson is one of the leading providers of online gaming products and services in the world. The company offers its customers a complete range of sports betting, casino, bingo and poker products through its own websites and mobile apps. In this article, we will take a look at the Betsson Android App and iOS App. We will also explore the features of these apps and find out how to download them on your device.

Betsson Mobile Sports Betting App

The Betsson Mobile Sports Betting App is one of the most popular sports betting apps in the world. The app offers a wide range of features that allow you to place bets on your favourite sports. You can also use the app to track your bets and see the latest odds.

The Betsson Mobile Sports Betting App is available for download on the Google Play Store and the Apple App Store.

***

Sports Betting on Mobile

Nowadays, sports betting is not only done at physical sportsbooks but also on mobile devices. Mobile sports betting has become very popular as it is a convenient way to place bets. You can do it anywhere and anytime. There are many different mobile sports betting apps available, and one of them is the Betsson app.

The Betsson app is available for both Android and iOS devices. In this review, we will take a look at the features of the Betsson mobile app and how to use it.

***

Is the Betsson Casino Mobile App Free?

The Betsson Casino Mobile App is free to download and use. There are no hidden fees or charges. You can use the app to bet on sports, play casino games, and even virtual sports.

The only time you will be charged is when you make a deposit or withdrawal. Deposits are free, but withdrawals may be subject to a fee depending on the method you choose.

Overall, the Betsson Casino Mobile App is a great way to gamble on the go. It is user-friendly and has all the features you need to make the most of your betting experience.

***

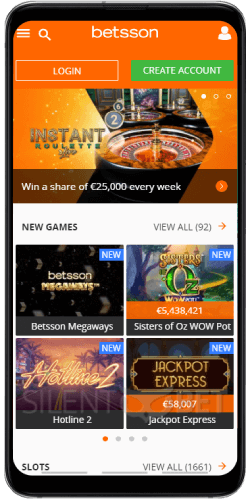

How to Use the Mobile Casino App?

The mobile casino app is very user-friendly and easy to use. To start playing, all you need to do is log in with your Betsson account details. If you don’t have a Betsson account yet, you can create one directly in the app. Once you’re logged in, you can choose from a wide range of casino games, including slots, table games, and live casino games. You can also make deposits and withdrawals and take advantage of the many bonuses and promotions available.

The mobile casino app is available for both Android and iOS devices. To download the app for Android, simply go to the Betsson website and click on the ‘Download for Android’ button. For iOS devices, you can find the app in the App Store.

Betsson Betting App Features

The Betsson betting app offers a wide range of features to make your betting experience as enjoyable and convenient as possible.

Some of the main features include:

– Live betting: You can place live bets on a wide range of sports, including football, tennis,, and more.

– Cash out: This feature allows you to cash out your bet before the event has finished.

– Betting history: You can view your betting history and track your progress.

– Live scores and statistics: Stay up-to-date with live scores and statistics for all the latest sporting events.

– Customer support: If you need any help, you can contact customer support directly through the app.

How to Download the Betsson Casino App for Android?s

To download the Betsson Casino App for Android, simply go to the Betsson website and click on the ‘Download for Android’ button. Once the file has downloaded, open it and follow the instructions to install the app.

Please note that you will need to allow unknown sources in your device’s settings before you can install the app.

To do this, go to ‘Settings’ and then ‘Security’ and tick the ‘Unknown Sources’ box.

System requirements and compatibility

The Betsson Casino App is compatible with Android devices running version

To check what version of Android you have, go to ‘Settings’ and then ‘About Phone’ and look for the ‘Android Version’ section.

Your device must also have a minimum of 50MB of free storage space in order to install the app.

The app is also available for iOS devices. To download the app, simply go to the App Store and search for ‘Betsson Casino’.

The minimum requirements for iOS devices are iOS 11.0 or later and a minimum of 50MB of free storage space.

***

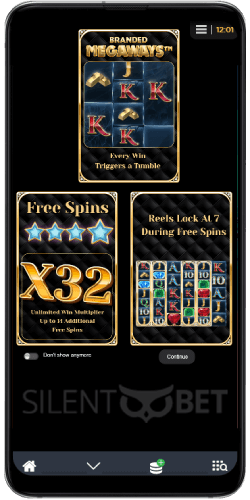

Mobile Casino Games

The mobile casino app from Betsson offers a wide variety of casino games that are sure to keep you entertained for hours on end. Some of the most popular mobile casino games include:

– Blackjack

– Roulette

– Slots

– Video Poker

– Live Casino Games

What’s great about the Betsson mobile casino app is that it offers both real money and play money games. This means that you can test out the casino games for free before you decide to wager any real money.

If you’re looking for a truly immersive casino gaming experience, then you should definitely check out the Betsson Live Casino. The live dealer games are broadcast in real-time from a professional casino studio. You’ll be able to interact with the dealer and other players at the table via the chat function.

Some of the most popular live casino games offered by Betsson include:

– Blackjack

– Roulette

– Baccarat

– Casino Hold’

Top Bonuses

When you download the Betsson mobile app, you’ll be able to take advantage of some great bonuses and promotions. New players can claim a 100% match bonus up to €100 on their first deposit. There are also regular reload bonuses and free bet offers available for existing customers.

If you’re a fan of casino games, then you’ll be happy to know that Betsson also offers a generous welcome bonus for new casino players. You can claim a 100% match bonus up to €100 on your first deposit. Plus, there are loads of other ongoing promotions and bonuses available for existing casino customers.

Casino & Live Casino

***

The Betsson Android app is available for download on the Google Play Store. The app is compatible with Android devices that have a version of

Android KitKat (version four) or higher. The Betsson iOS app can be downloaded from the App Store and is compatible with iOS devices that are

running iOS 11.0 or later.

Virtual Sports

The Betsson Android and iOS app offers a wide range of virtual sports betting options. You can bet on virtual football, horse racing, greyhound

racing, and more. The virtual sports betting markets are updated regularly so you can always find something to bet on.

Payment Methods

The Betsson Android and iOS app offers a wide range of payment methods. You can deposit and withdraw using your credit or debit card, e-wallet, or

paysafecard. The minimum deposit amount is €/$/£ ten and the maximum withdrawal amount is €/$/£ five thousand per day.

Betsson Betting App Customer Support

The Betsson Android and iOS app offers customer support 24 hours a day, seven days a week. You can contact customer support via live chat or email. The Betsson betting app is available in a wide range of languages including English, Swedish, Norwegian, Finnish, and German.

Betsson Betting App Verdict

The Betsson betting app is a great way to bet on sports and play casino games on the go. The app is easy to use and offers a wide range of betting markets and payment methods. The customer support team is available 24/ seven to help you with any issues you may have. The Betsson betting app gets a thumbs up from us!